While APPs like PayPal, Venmo, CashAPP, etc are filling in some gaps for unbanked customers, could they also be making financial exclusion worse?

A recent article on vox.com explored this question for US consumers.

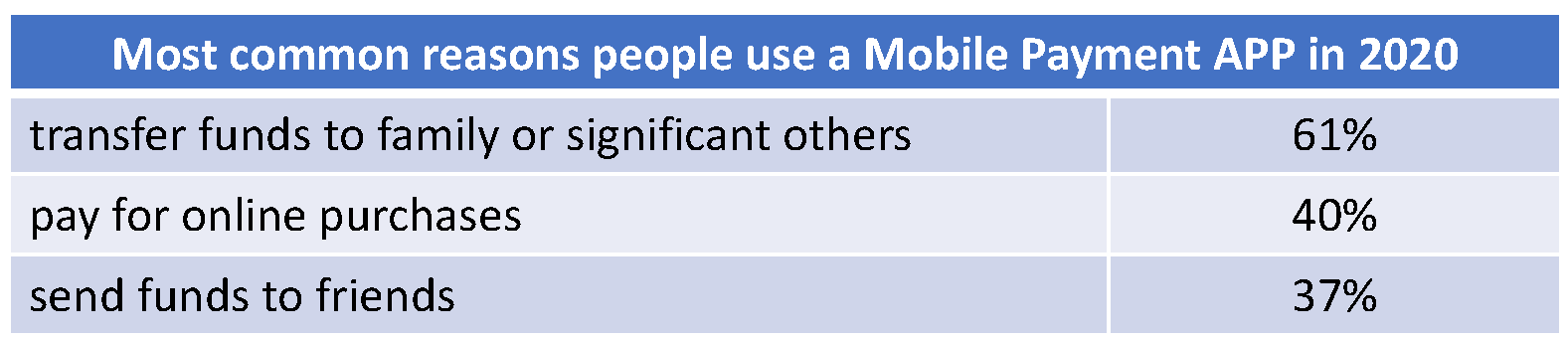

A growing number of consumers in the US rely on mobile payment apps to manage their finances. There are a number of reasons for this, and a 2020 Nerdwallet survey found that nearly 4 in 5 respondents use mobile payment apps, including Venmo, Cash App, Apple Pay, and PayPal.

Source: Nerdwallet survey, Feb. 2020

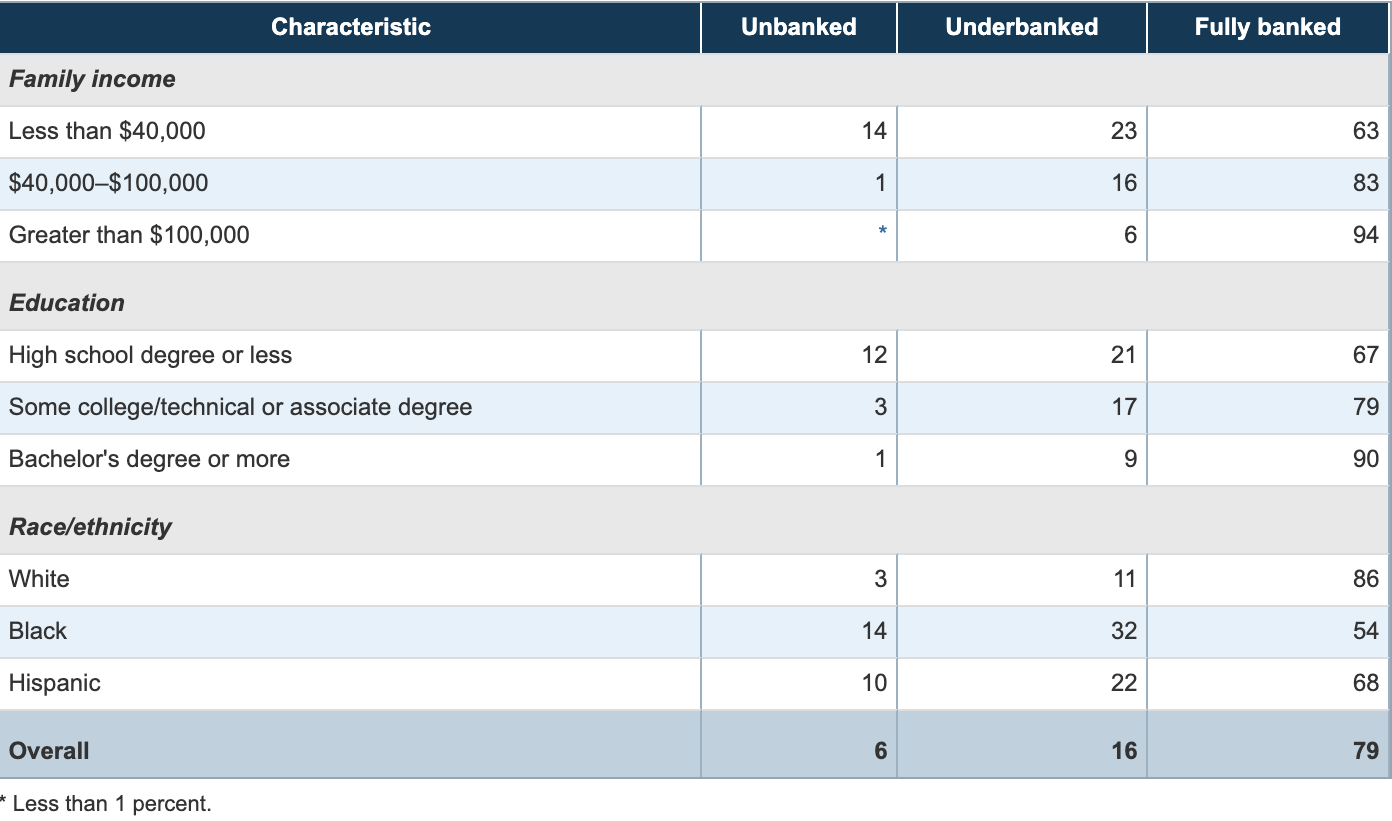

A 2020 Federal Reserve report (link) reported that in 2019, 6% of US adults were unbanked 16% were underbanked or had a bank account, but relied on services like payday loans, check cashing services, or money orders.

This report also delved into who these customers were and noted that unbanked and underbanked consumers were more likely to have less education or to be part of a racial or ethnic minority group.

Source: US Federal Reserve Report, May 2020

The Nerdwallet survey also found that the top users of mobile payment APPs are Milllenials (94%) followed by Gen Zers (87%).

One possible explanation for this is that Payment APPs like Google Pay or Apple Pay are built into smartphones, making their use very convenient.

So are payment APPs good for people with and without bank accounts?

Over the past year there has been a marked increase in the use of mobile payments as they have generally been used for contactless transactions and are deemed better for public health.

For underbanked customers, in particular, mobile payment APPs give users access to their money without needing to go to an ATM. This is a distinct advantage for people living in low-income communities which tend to have fewer ATM locations nearby.

For consumers with family in other countries, sending funds through payment APPs can allow them to carry out a number of transactions, such as bill payment and eCommerce purchases, within the payment APP which is another advantage.

On the other hand, payment APPs can carry some disadvantages for the users:

Fees - Payment APPs often come with their own fees for credit card transactions and can result in interest for charges that aren’t quickly paid off.

Customer Service - Technology works great until it doesn’t. There is generally a lack of a customer services infrastructure for payment APPs and they tend to have a hands-off approach, opting to provide users with guides rather than a person to assist users with inquiries.

Financial documentation - Customers’ payment APP transaction data aren’t included in their creditworthiness assessments, meaning possibly eligible consumers could be excluded from traditional financial services such as loans and mortgages.

Security - For users without secure wifi, public wifi networks are less secure. Also, only 7% of all US adults don't have internet access, when you look at access by income 14% of adults making less than $30,000 don't have secure wifi.

Top-ups - Perhaps the biggest disadvantage of all for unbanked and even the underbanked is how do you load cash to a payment APP if you don't have a bank account, credit or debit card? With some payment APPs the user can load cash onto a prepaid card and add that card to their account as a workaround for unbanked consumers. Another emerging solution growing in popularity is the barcode based Top-Up like the one available from Pipit eWallet partners. This in-APP function allows the user to generate a barcode for the amount they wish to add to the APP, then then take the barcode to their nearest Cash Collection Point, where it is scanned at the POS and the cash is loaded instantly.

So, for unbanked and underbanked consumers who mainly conduct financial transactions via their phones, they may face technological and security constraints if they can't access secure wifi, if their phone is out of date, or if they live in a rural area with poor connectivity. Research shows that unlike traditional banks, payment APPs either offer little to no fraud protection for consumers.

Conclusion

As underbanked and unbanked consumers use payment APPs to conveniently send cash to others, manage their money and access otherwise out-of-reach financial services; it is important to remember that many APPs can also come with costly fees, a lack of customer service, and cybersecurity risks.

If left unaddressed, payment APPs could further replicate offline inequality for unbanked or underbanked users.

What do you think? We'd love to hear your comments!