The traditional remittance model has always been the transfer of a cash amount person-to-person either through formal or informal channels. Cash-in at the sending side, cash-out at the receiving side. It’s a practice that has been around for a long time.

Step back into the recent past – or further if you wish - and you’ll find just how fundamental and crucial cash remittances have long been to the lives of millions around the world. And, if you look to the present day, you’ll see just how fundamental remittance remains.

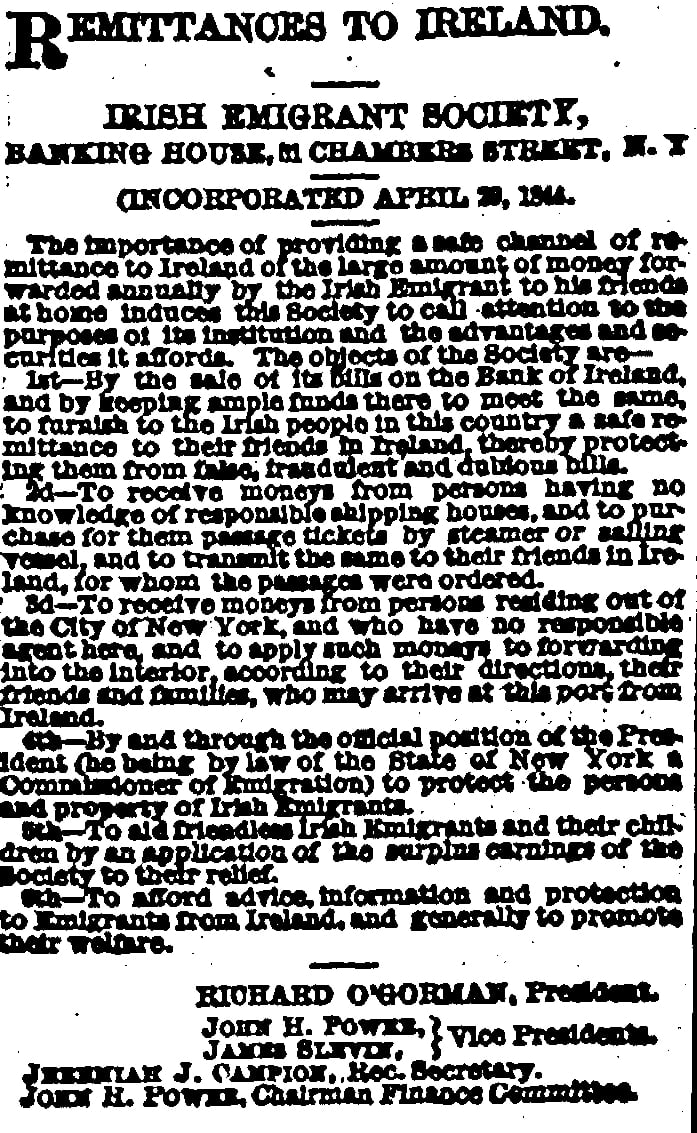

Take, for example, Ireland, whose long history of migration stretches back to the 1840s and the Irish Famine, and further still to the latter half of the sixteen-hundreds during the Cromwellian regime. In the 1850s, the Irish diaspora in America - in the form of the Irish Emigrant Society - established The Emigrant Industrial Savings Bank, with the goal of serving the needs of the Irish immigrant community in New York. Amongst the aims of the bank were to provide a safe means of remitting funds back to families in Ireland.

The requirement for safe and reliable remittances, and the desire to control the cost of remittances, were as much issues back in time as they are today. Italy, for instance, was the first country in the world to enact a law to protect remittances in 1901, and in 1960 Spain and Argentina were the first countries to sign an international treaty to lower the cost of the remittances.

So, whilst governments and institutions take steps to protect senders and receivers of remittances, there remains a concern principally in the minds of remittance senders beyond the scope of government and service providers...

How is the money being spent?

Whilst the traditional cash-to-cash remittance model clearly has served migrants and their friends and families well over the years, there is no certainty that funds remitted will always be used for their intended purpose. This may be due to simple misuse, or perhaps unforeseen circumstances taking priority. Either way, the result may be that vital payments for rent, utilities and other services may be missed.

Recognizing this problem, Pipit Global developed and included in its service offerings from the very start of operations a cross-border bill payments solution. In this model, rather than remitting a cash amount to cover all at-home expenses of a migrant’s family, the sender can pay bills directly to the supplier through Pipit’s global bill payments platform for a variety of purposes.

This innovation means that a migrant can have control on where the money goes, and can ensure that the bills do get paid. The remittance has a defined purpose.

The rise of for-purpose remittances

The ability for a sender of remittances to have control over what a proportion of the money sent is used for, is becoming an important feature in the development of the remittance service industry.

Research carried out by South African based independent African economic impact agency Cenfri has established that there is a strong case for the continued development of ‘for purpose’ remittances.

In their report into the case for ‘for-purpose’ remittances, Cenfri provide some fascinating insights into the shape of the remittance market from the points of view and experience of both senders and receivers.

The research, carried out in 2019 and based on remittance senders in the UK and receivers in four African countries – Cameroon, Kenya, Nigeria, Uganda – highlighted a number of key considerations for service providers to understand when addressing innovation in remittances.

Who do remitters send money to?

According to the respondents participating in the study – 1,146 respondents – remittances were sent to the following groups:

- Friends – 82%

- Siblings – 77%

- Extended Family – 77%

- Parents or Grandparents – 76%

- The community – 53%

- Children – 47%

- Husband/Wife/Partner – 34%

What is the intended purpose of the funds?

- Health

- Household expenditure

- Celebrations

- School fees

- Bill payments

- No specific reason

- Funeral

- Business

- Loan payments

- Insurance

Is there a case for labelling remittances?

The Cenfri research project looked at the potential for the development of a for-purpose labelling solution for use with remittances.

In the first model, a simple label is attached to the remittance specifying what the funds are to be used for. Labels are either selected from number of options or can just be attached in a note. Of the survey sample 71% said they would use such a labelling service.

In the second model – designated as ‘enforced labelling’ – the remitter would be able to send funds directly to a biller or supplier. This option would be used by 69% of respondents. A key component of this model is trust. Respondents identified the institutions they would likely trust using this method:

- School – 55%

- Health Institution – 49%

- Utility Company – 39%

- Financial Institution – 36%

- Construction Company – 35%

- Insurance Company – 21%

Innovation with purpose

It’s worth noting that sometimes the seemingly simplest ideas can lead to effective innovation.

Understanding the needs and wants of customers goes a long way to ensuring that innovations pursued become solutions to a problem rather than solutions looking for a problem.

And, given the high level of potential take-up of for-purpose remittances, it appears that a labelling model or direct-to-biller remittance are just such problem solving innovations.