Consumer research carried out in March 2020 by UK consumer group Which? examines why access to cash still matters for a significant percentage of the UK population and the barriers these consumers have faced when trying to pay with cash during the pandemic.

This new research shows that many people are still reliant on cash for a number of reasons: (1) they can’t / are unable to use mobile or internet banking; (2) live in remote areas where their broadband connection is unreliable; (3) local retailers only accept cash.

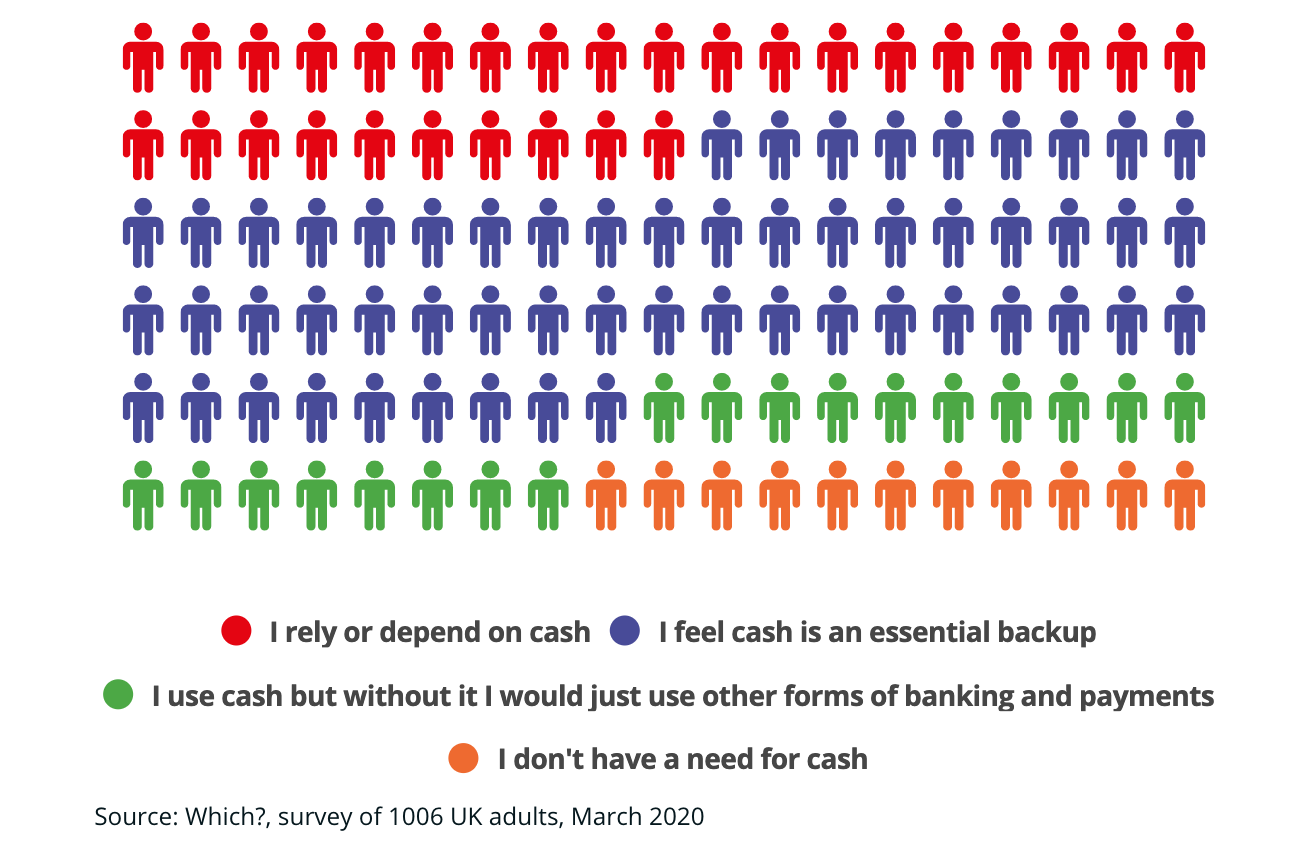

Here is a useful summary of the results which shows 25% of respondents dependent on cash for their household management and a further 50% stating that they consider cash as an essential back up to digital payments.

Nearly 50% who rely or depend on cash are over 65, while 30% are aged 55 - 64. Both groups are more likely to need to self-isolate and ask friends, family or volunteers to shop for them. 67% of those who depend on cash have no digital skills, while 52% have basic digital skills.

The pandemic has also made it difficult to manage a bank account; and being able to withdraw cash only helps if you’ve got money in your bank account, or indeed if you have a bank account to begin with.

This new data again highlights the need for the government to legislate to protect the role of cash within the economy.

Read the full article here:

https://www.which.co.uk/news/2020/06/coronavirus-cash-crisis-puts-millions-of-people-at-risk/