There is an assumption today that everyone has a bank account. This is not the case.

According to the latest report from the World Bank, there are as many as 1.7 billion adults (31%) around the world without an account at a financial institution or through a mobile money provider. In 2014 this number was 2 billion.

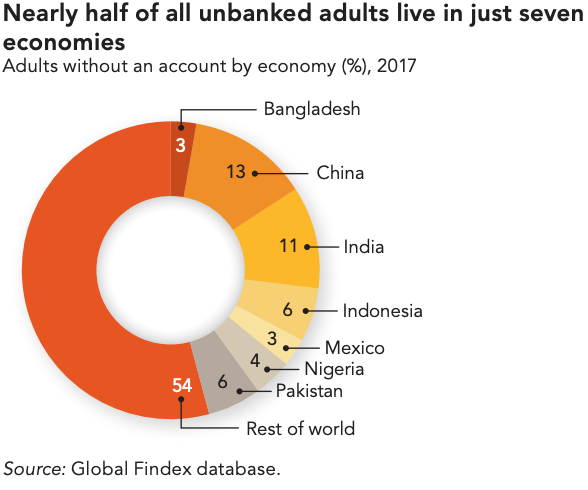

This assumption is made within developed / high-income economies where bank account ownership is nearly universal; so it is unsurprising to learn that almost all the ‘unbanked’ adults live in developing countries. In fact, 46% of the 1.7 billion unbanked adults live in just 7 economies.

So, who are the ‘unbanked’?

Research shows that in many developing economies, wealth is not the only identifier of this population segment – and many unbanked adults are just as likely to come from wealthier households as from poorer ones.

The Global Findex Database also gives the following insights on the global unbanked population:

- 30% are between 15 and 24 years old.

- 53% are either employed or seeking work

- 27% of those who are economically active are self-employed, the majority of who get paid in cash.

The report goes on to explore the reasons why 31% of the global adult population don’t have an account, and the main reasons cited are as follows:

- I don’t have enough money to have a bank account.

- I don’t need a bank account – (This suggests that some might be open to using financial services if the services are accessible and relevant to their lives)

- Bank accounts are too expensive

- A family member already has an account

- There is no bank nearby

- I don’t have the necessary documents

- I don’t trust financial institutions

Not having a bank account can cause difficulties in everyday life, from getting paid and regular saving to paying for utilities and shopping online; and the Global Findex Report also examined how the unbanked population make and receive payments and the issues they face while doing so. In the majority of cases ‘over the counter’ cash payments are the norm, with many people giving up time to travel and queue to carry out their weekly essential transactions.

Digital finance and mobile money

The research suggests that digitizing these payments will increase the speed of payments and reduce the cost of disbursing and receiving them. It will also enhance payment security and lower the risk of associated crime.

Where lack of trust in financial institutions is a barrier to bank account ownership the real opportunity for business growth and financial inclusion is through the use of mobile phones and the internet. The report states that “… about 1.1 billion unbanked adults—about two-thirds —have a mobile phone.”

But mobile phones and the internet can drive financial inclusion only if they are supported by the necessary physical infrastructure—such as reliable electricity and mobile network.

Another consideration is that digital payments are only part of the solution. People using digital payments need to be able to deposit and withdraw cash safely, reliably, and conveniently at cash-in and cash-out points, whether these take the form of a post office, bank agent, a mobile money agent, or an ATM. This is the crucial step to bring the unbanked population into today’s digital marketplace.

In many places digital payments are not yet widely accepted for everyday purchases, especially in developing economies. So most people need to be able to cash out at least some of the money they receive through digital payments.

The one outlier in the digital payment space is Utility Payments, and that data shows that cash payments are the norm both for those with or without bank accounts in both developed and developing economies. The research states that “A billion adults who have a bank account still pay utility bills in cash”

Innovations in the utility bills payment sector are rapidly changing this pattern of behaviour and wider acceptance and use of mobile money accounts in economies where people are more likely to have a mobile phone than an debit card, is enabling these consumers to leapfrog straight to mobile payments.

Fintech companies like Pipit Global are working hard behind the scenes building partnerships with billers around the world to grow the Pipit Cross-border bill payment service which now offers access to over 1000 billers in almost 50 developing nations complete with regional knowledge but with financial connections on a global scale.

Pipit B2B partners, such as banks, eWallets and APPs can offer this bill payment service to their customers who can then pay their bills directly from a growing number of Pipit cash collection points in both developed and developing economies.

https://globalfindex.worldbank.org/