A mere decade ago the big banks and MTOs* of the world had a stranglehold on international money transfers and the associated fees were sky high.

Thankfully our generation of fintechs has changed this and the birth of digital payments has dramatically cut the cost of moving money around. Fees have fallen and processing time has been reduced.

Yet one corner of this industry has been left behind – remittances i.e. the practice of foreign workers sending money to relatives back home.

This flow of money to developing countries remains consistent at approximately $550bn annually – more than all the capital they receive as investment from multinational companies (World Bank).

There are 266m migrants globally who send money home on a regular basis – many of them are poor, and so are almost all their relatives. Remittance prices remain high, 7% on average but can be up to 25% in parts of Africa (South Africa to Nigeria).

There are a number of reasons for these high costs:

- The market is dominated by a small number of global players who charge high fees to maintain their huge cash-in and cash-out networks. For example, Western Union, has over half a million physical sites around the world.

- Cash is expensive to handle safely and securely; and very often either the migrant workers hand over hard-earned banknotes, or, back home, the cash is handed over to their unbanked families.

However, things may be slowly starting to change, as the market opens up to technology and mobile money methods start to gain a foothold, we may well see a move away from banks and transfer firms altogether.

Across Africa, Asia and Latin America millions of people are now using ecommerce, mobile APPs and eWallets. Our new generation of fintechs are working out how to link all these local networks together to offer seamless cross-border payment methods.

Cross-border Bill Payments

Research shows that money sent home is used primarily for day-to-day living expenses, but a lot of it is used to pay regular bills like school fees, rent and utilities.

One emerging fintech innovation is where migrant workers can now directly pay cross-border bills from their host country, for themselves or on behalf of family members, bypassing the multi-step traditional path of ‘remit cash to family, pay bill locally’. This method has significantly lower fees for the consumer, is traceable, gives peace of mind and ensures timely payment of essential family expenses.

Fintech companies like Pipit Global are working hard behind the scenes building partnerships with billers around the world to grow the Pipit Cross-border bill payment service which now offers access to over 1000 billers in almost 50 developing nations.

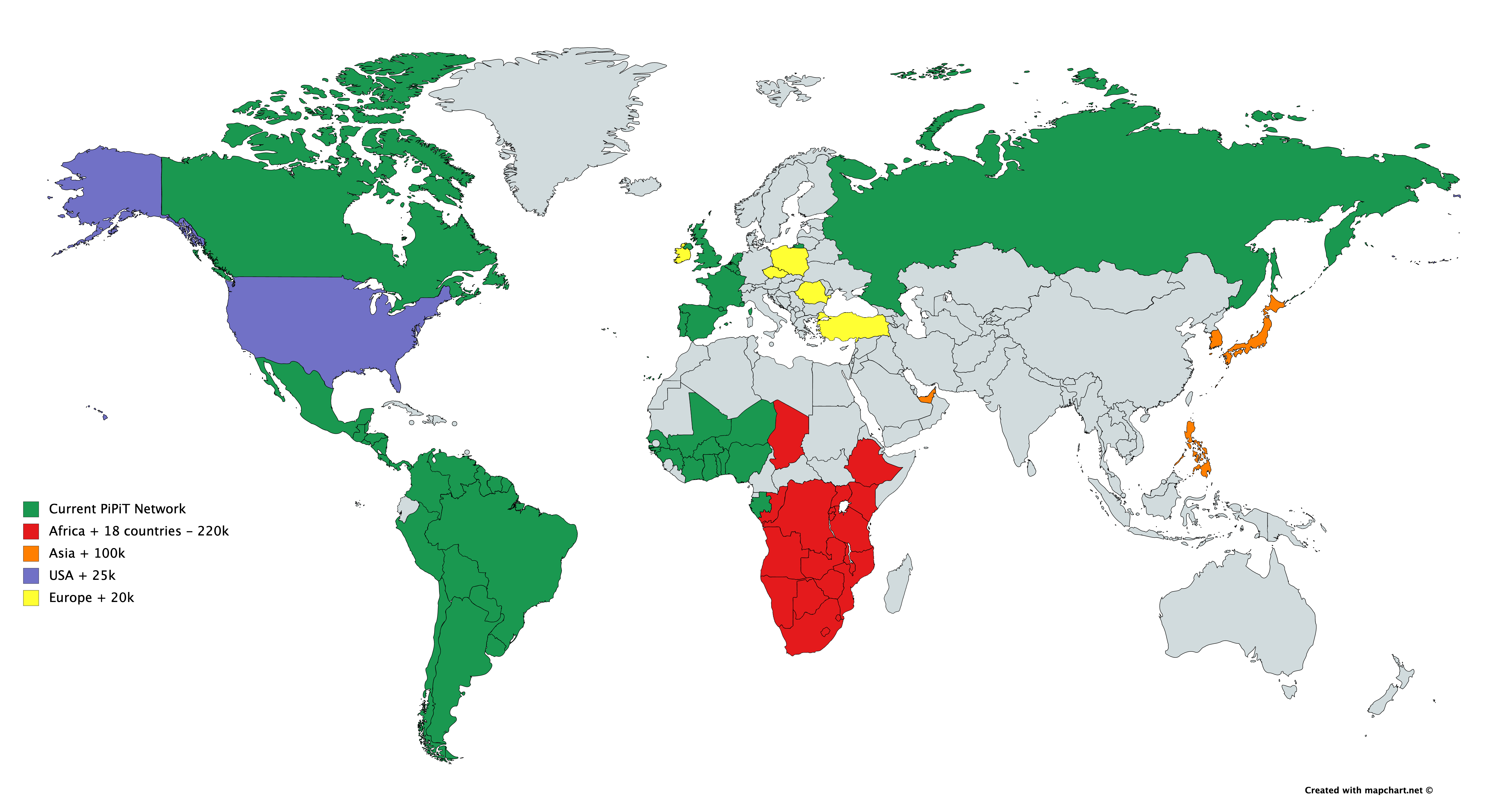

Pipit B2B partners, such as banks, eWallets and APPs can offer this bill payment service to their customers who can then pay their bills directly from a growing number of Pipit collection points around the globe (see the map below):

*Money Transfer Offices